To stay sustainable: the insurance industry needs an urgent paradigm shift!

Mr. Praveen Gupta.

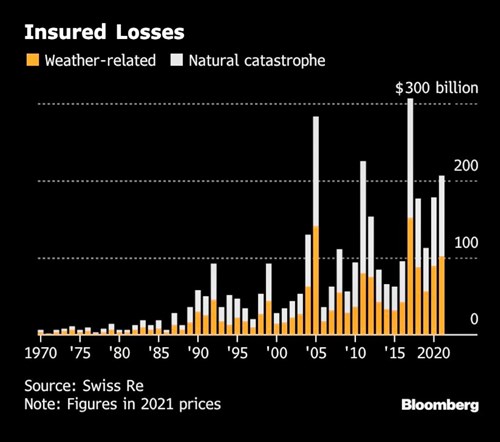

As global temperatures keep rising above the pre-industrial times, the stability that we took for granted is in a state of flux and headed for irreversible consequences. This is thanks to the over-exploitation of Nature - resulting in Climate Change together with biodiversity loss and pollution. Munich Re sees climate change and La Niña as two of the drivers for a US $120 billion annual disaster insured loss for 2022.US $100 billion or more is the “new normal” for the global insurance industry’s annual natural disaster loss total.

Insurers have a critical role in mitigation, adaptation and resilience. To stay sustainable they must, therefore, respond to the emerging order urgently. The current performance metric has outlived its utility - the way risks manifest, impact, get measured, priced, reported, regulated - all changes. With these threats come some of the biggest business opportunities.

Causa Proxima: Conventional risk silos demand urgent revisit. Climate risks manifest as physical, transition and liability risks. Physical risk arises from physical impacts of climate-induced extreme weather events, transition risk relates to changes in regulatory and market expectations arising from the transition to a low-carbon economy. Liability risk emanates from mismanagement of physical and transition risk. Also, a new highly complex and destabilised domain of risk is emerging. It includes the risk of collapse of key social and economic systems at local and global levels. Not only are political boundaries being rendered irrelevant, but some of them have serious inter-generational implications.

Pricing externalities: Plastic may be a highly profitable product for its manufacturers but the environmental havoc it creates is before our eyes. Factoring costs of carbon emissions would render many businesses unviable. As underwriters and investors, insurers need to address this. The likes of AXA, Allianz, Aviva and Swiss Re, have pledged to decarbonise their underwriting portfolio as members of the Net-Zero Insurance Alliance. High frequency and severity losses have forced insurers to ‘redline’ losses due to forest fires in Australia and California.

Modelling: It is also important that insurers proactively build climate capabilities with forward-looking climate risk modelling instead of historic data. Weather-related losses are becoming a growing component of Nat Cat. With return periods shortening, the 100-200-year cycles are generally redundant. Uttarakhand being a shining example.

ESG: Together with environment and societal components, governance is about diversity of stakeholders. IFRS is in the process of embedding sustainability in its reporting protocol. Thereby, not only will the harm to insurer balance sheets from climate change be accounted for, but so will the damage caused by insurer actions to environment (under the proviso of double materiality). Insurers will also be reporting under The Taskforces on Nature-related Climate Disclosures (TNFD) and Climate Related Climate Disclosures (TCFD). The Dasgupta Review strongly reinforces that the economy is a wholly owned subsidiary of the environment.

South Asia’s Hotspots: Impacts of Temperature and Precipitation Changes, a report by the World Bank, highlights economic impact climate change will have in South Asia. It is expected to reduce GDP by over 10 per cent. However, this does not take into account the increasing severity of storms, changes in water resources and sea level rise, climate-induced migration, biodiversity loss, pollution and the compounding impact multiple shocks can have. The report serves as a reality check for any South Asian insurer seeking mouth-watering growth.

India: With much of the developed world shutting out fossil fuel related insurance business, India would be vulnerable to inflow of ‘dirty’ reinsurance. As the third most polluting economy it would invite significant reputation risk. With some of the most polluted cities in the world, health and life products could become unaffordable or unavailable. Rapid transformation to renewable energy - risk fossil fuel assets turning stranded.

Opportunities: McKinsey expects voluntary carbon markets (VCM) to reach up to US $30 billion by 2030. Needless to mention, VCMs are currently mired in serious controversy and trust deficit. Annual global investments in decarbonisation technologies and renewables could account for USD 800 bn by 2030 corresponding to USD 10 bn to 15 bn in insurance premiums. Rise in extreme weather will render indemnity coverage less affordable and lead to greater demand for parametric offerings; income loss on renewable assets as well as the impacts of chronic weather shifts on climate-exposed sectors are expected to be the other growth drivers. However, the highest potential near-term target markets for insurers are likely in proven renewable-power assets and established green technologies including solar, on- and off-shore wind, electric-vehicle (EV) batteries, and EV charging infrastructure (EVCI).