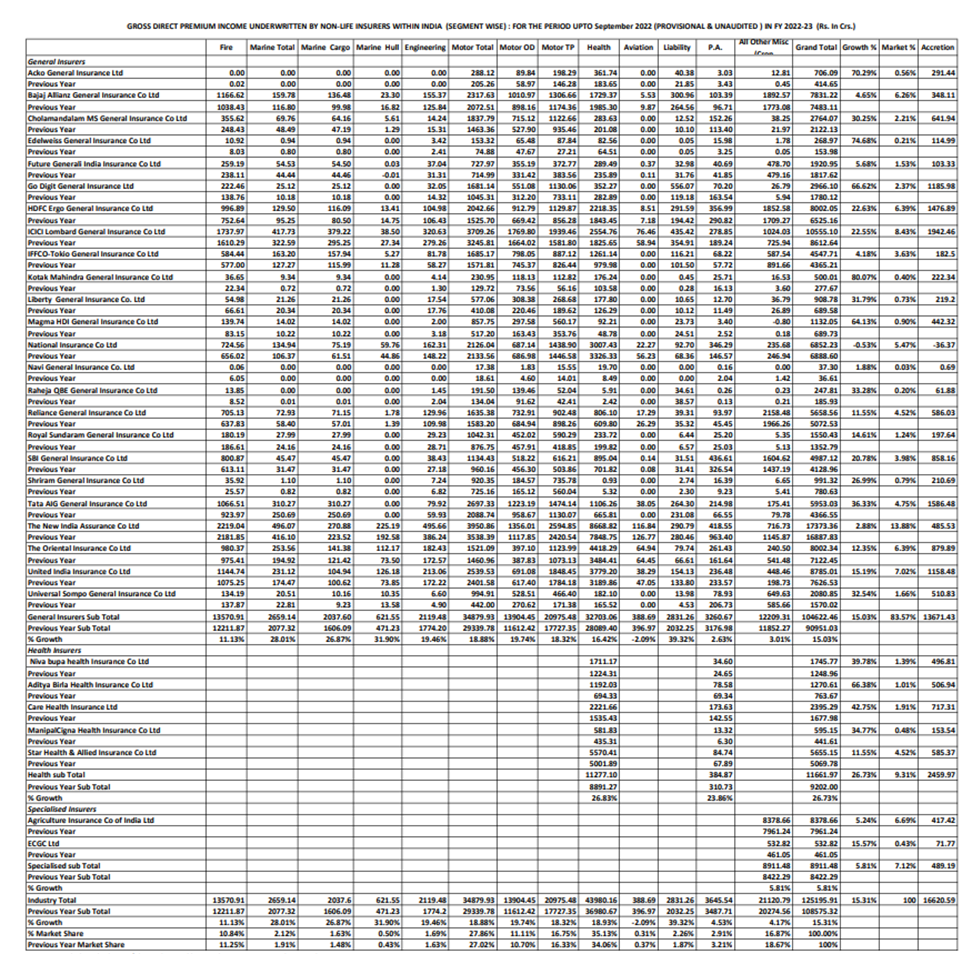

The Premium Score Board October 2022

The non-life insurance industry comprises of 24 multiline insurers, 5 Stand Alone Health Insurers (SAHI) and two specialised insurers, namely, Agriculture Insurance Co of India Ltd and ECGC Limited, thus totalling up to 31 general insurers. For the period April to September 2022. These companies together have logged an underwriting premium income of about Rs. 1,25,196 crores, showing a growth of around 15.31%. Out of this, the multiline insurers (general insurers) have contributed premium income of Rs. 1,04,672.46 crores with an accretion of 15.03%. SAHI have contributed a premium of Rs. 11,661.97 crores, showing an accretion of 26.73% and specialised insurers have underwritten premium of Rs. 8911.48 crores with an accretion of 5.18% over the corresponding previous financial year period.

The industry is growing at a healthy accretion of 15.31% even as we are still recovering from the COVID after-effects. Health insurance continues to occupy a dominant market share of 35.13% followed by Motor Insurance at 27.86% of the total pie. For the industry to achieve higher growth rates, there is great scope in the Motor Third Party (TP) premium with nearly 50% of the vehicles uninsured. Motor TP business being compulsory in nature, we hope that the enforcement authorities like the Police and Reginal Transport Officers (RTOs) take effective action in ensuring that the mandatory Motor TP insurance requirements are complied with.

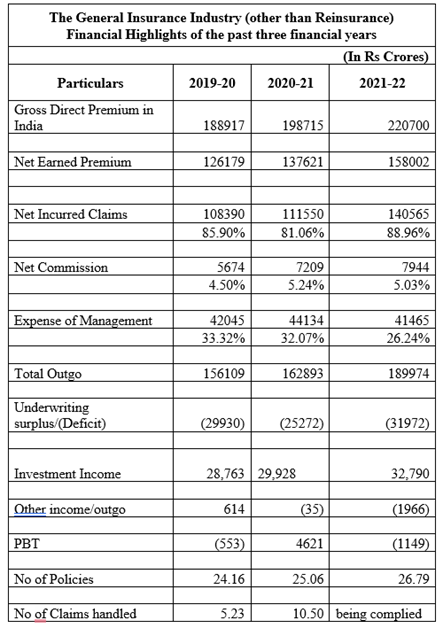

Financial highlights of the General Insurance Industry (other than reinsurance) for past three financial years

From 2019-20 gross direct premium increased from 188,917 cr. To 220,700 in 2021-22 wherein net incurred claims have been increased from 81.06% to 88.96% in 2021-22