Premium Score Board June 2023

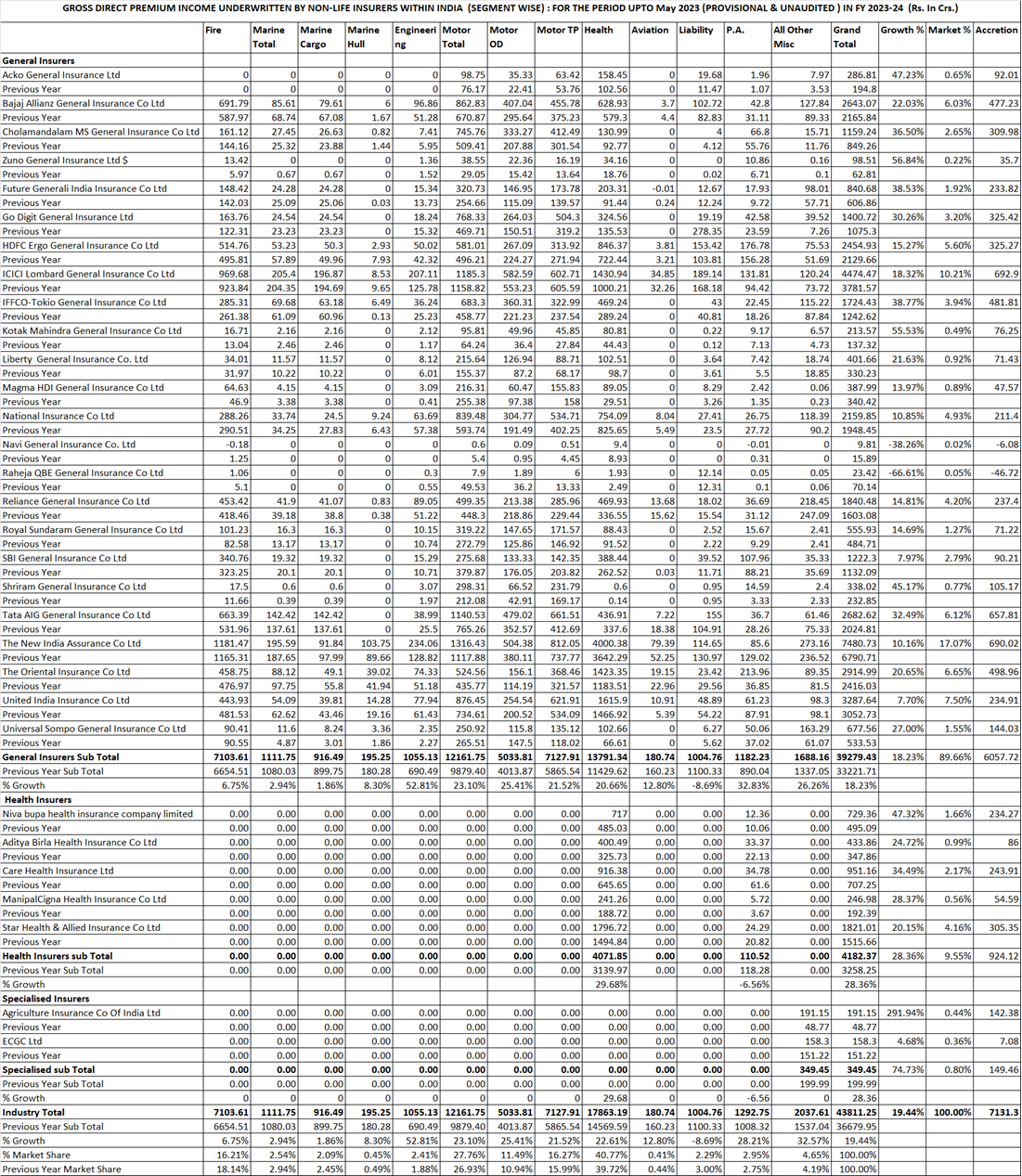

The financial year 2023-24 for the non-life industry started off well, with premium growth at the end of May showing 19.44%, which indeed is impressive but slightly lower than the previous month, which was over 20%. The high-growth segments include Engineering, Motor, Health, and Misc., whereas the growth percentage in fire, marine, liability, and aviation insurance is in single digits. The total premium of the non-life industry stands at Rs 43,811.25 crores, as opposed to the previous year's total up to the month of Rs 36,679.95.

The Council welcomes Kshema General Insurance as its new member, and the total number of direct insurers is now 32, which includes 25 multiline insurers, 5 Stand Alone Health Insurers (SAHI), and 2 specialized insurers. Apart from these, 12 reinsurers are also council members.

Although all the above figures are provisional as of the date of publishing the newsletter, a few business trends are clearly visible in the non-life industry. The non-life industry continues its high-growth journey, working towards deeper penetration of insurance services. However, a much higher rate of growth is required to achieve the ambitious penetration targets set by IRDAI and Insurance for all by 2047.

The highest-growing segment is Engineering, with a growth rate of 53% up to May 2023, indicating high investment in new projects and/or infrastructure development. Health insurance continues to be the largest segment, with a growth rate of 23%, constituting 40% of the total non-life premium. Motor is the second-largest segment, with a growth of 23% and a market share of 28%. Together, health and motor constitute approximately 70% of the total premium of the industry.

The private sector companies, which now generate about 2/3 of the total industry premium, continue on a high-growth path, which is much higher than that of PSU companies.